- The global growth of the branded residences sector is forecast to continue, with the Middle East leading the charge by pipeline growth

- By scale of increase from current supply of branded residence schemes, Egypt, Saudi Arabia, Cyprus, Qatar, and Costa Rica each recorded growth of more than 300%

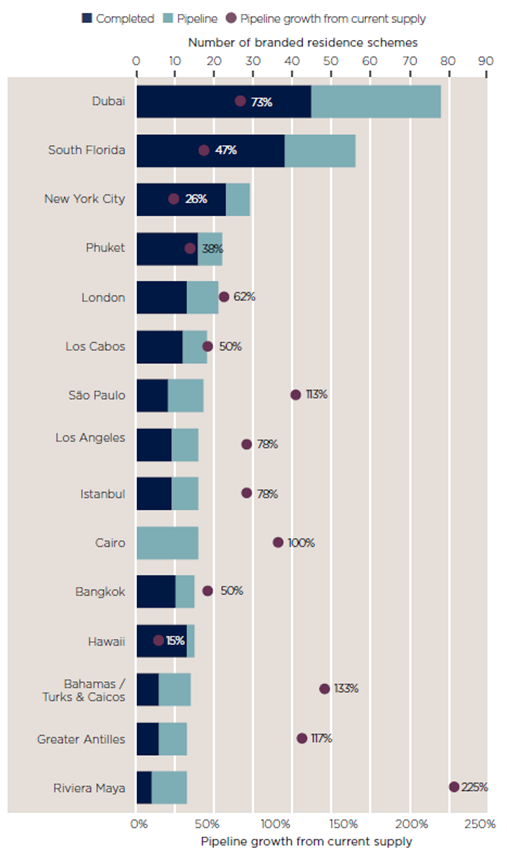

16 November 2022 – Dubai, South Florida, and New York are the top three locations for branded residences globally, based on their supply of completed and pipeline schemes, says real estate advisor Savills in its latest Spotlight on Branded Residences. These areas have well-established luxury property markets and attract a range of domestic and international buyers both for business and cultural activity.

Top hotspots for branded residences schemes

Completed and current pipeline

Source: Savills Research and Savills Global Residential Development Consultancy

Branded residences, as a property sector, have proved to be incredibly resilient in the face of global uncertainty and change. Over the past 10 years, the sector has grown by over 150%, and the pipeline of future branded residences remains strong. Today, there are 640 schemes, accounting for nearly 100,000 units, operating across every continent, except Antarctica. Supply levels are forecast to exceed 1,100 schemes by 2027, nearly doubling current levels.

Riyan Itani, head of global residential development consultancy, Savills, said, “After a number of years of evolution, the branded residences sector has proven resilient and adaptable to adverse market conditions, offering security and reliable quality to buyers and attractive returns to developers and brands. With a robust and geographically diverse pipeline, as well as the continued commitment to the sector from developers and brands, the sector is set to continue to expand in the near term.”

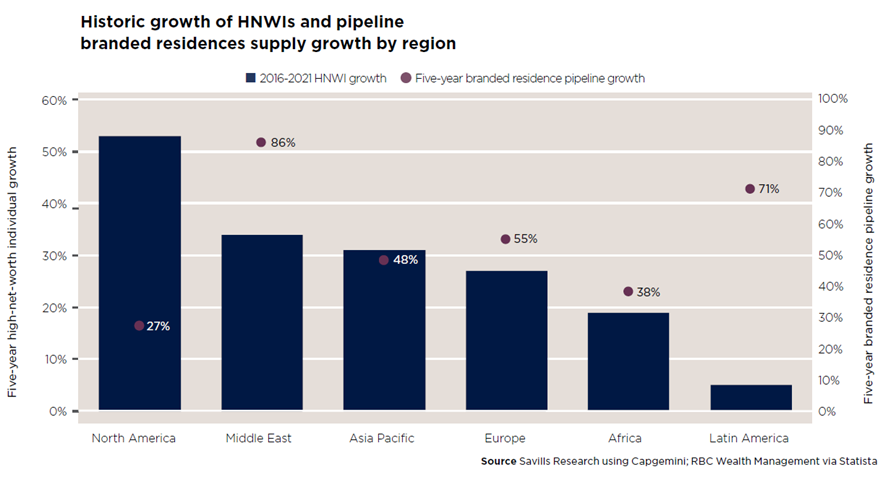

In the Middle East and Asia Pacific, growth hotspots, both in terms of pure economic growth and wealth creation, are attracting more interest and development from global brands. The regions have seen 400% and 216% increases, respectively, in their levels of supply of schemes over the last decade. The global growth of the branded residences sector is set to continue, with the Middle East leading the charge by pipeline growth. Across the region, current supply is projected to increase 86% by the end of the forecast period. Central and South America (71%) is a close second in terms of supply growth and Europe (55%) completes the top three fastest growing locations.

By volume of pipeline, the United States, United Arab Emirates, Vietnam, and Mexico are forecast to add the largest number of schemes – more than 30 schemes in each country over the forecast period, with the US projected to add over 70 schemes. By scale of increase from current supply, Egypt, Saudi Arabia, Cyprus, Qatar, and Costa Rica lead the table, each with growth of more than 300%, further illustrating the trend of increased brand investment in the Middle East and Central and South America.

Swapnil Pillai, Associate Director – Research, Savills Middle East said, “Across the world, brands are looking for new locations to grow their portfolios and affluent, globally-mobile individuals will continue to drive demand for branded residences. Developers and brands are together identifying the hotspots of HNWI growth to enhance their offer. Over the past five years, the highest growth rates in terms of number of HNWIs were noted in North America (53%), followed by the Middle East (34%) and Asia Pacific (31%). This is in line with our observations with regards to the strongest increase of branded residence stock over the same period.

“Going forward, the Middle East is set to experience a strong increase in HNWIs over the next five years. The UAE is expected to record a 22% rise in the number of high-net-worth households whilst Saudi Arabia (13%), Kuwait (51%) and Qatar (22%) are also likely to witness healthy growth in the number of wealthy residents. This bodes well for the branded residential developments market in the region.”

Although still high, branded residential development growth in the top locations of Dubai, South Florida, and New York is slowing as many brands look for expansion opportunities in emerging cities and resort locations, according to the report.

Of the top 15 locations, 10 of them are either resort or emerging destinations, demonstrating how diversified the branded residence sector has become. Cities and resorts in emerging markets such as Phuket, the Caribbean, and Mexico are climbing the league table as buyers look for additional residences in holiday and seasonal areas. These locations are led by developments from both luxury and non-luxury brands

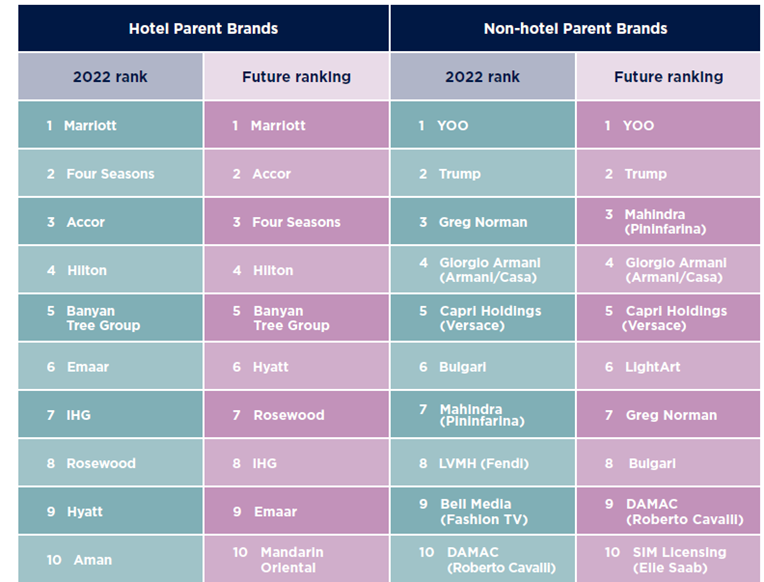

Key players by completed and pipeline supply

Parent companies and parent groups, with large numbers of brands under their umbrellas, continue to compete for market share and brand recognition. Marriott International remains comfortably atop the rankings for hotel parent companies, where it has been since 2002. However, in recent years, there have been rising stars and new entrants into the market both in terms of type and location of the parent brand. Accor, for example, ranks third by number of completed properties in 2022, rising from fifth place in 2021.

Non-US brands such as Emaar and Banyan Tree have risen to become global contenders. As more residents of regions outside North America and Europe move up the wealth ladder, there will be increasing demand for branded product which can cater to their needs.

For non-hotel brands, there is more activity and jostling for position compared to the hotel parent brands, however YOO remains top of the table. From the established players in design, fashion, golf, and wealth brands to newcomers from automotive, music, and art brands, such as the recent announcement of Louvre Residences in Abu Dhabi, the growth of non-hotel brands demonstrates that buyers do not appear to be limiting themselves to classic hotel offerings. Brands such as Mahindra (Pininfarina), LightArt, and DAMAC

(Roberto Cavalli) will ascend through the rankings going forward.

Fast growing economies such as Brazil, UAE and India are leading the table for the non-hotel pipeline, with each country forecast to see non-hotel brand scheme growth of more than 70% from current supply levels. The lifestyles offered by these non-hotel brands, and the fact that there are fewer residences in existence, provide the perfect combination for trophy assets for the growing number of wealthy individuals.

Top 10 parent brands

Source: Savills Research and Savills Global Residential Development Consultancy

About Savills

Savills plc is a global real estate services provider listed on the London Stock Exchange. With a presence in the Middle East for over 40 years, Savills offers an extensive range of specialist advisory, management and transactional services across the United Arab Emirates, Oman, Bahrain, Egypt and Saudi Arabia. Expertise includes property management, residential and commercial agency services, property and business assets valuation, and investment and development advisory. Originally founded in the UK in 1855, Savills has an international network of over 600 offices and associates employing 39,000 people across the Americas, UK, Europe, Asia Pacific, Africa and the Middle East.

For further information about Savills: www.savills.com